For most Americans, tax season is accompanied by a soundtrack of wailing and gnashing of teeth. According to Pew Research Center, 56 percent of Americans hate or dislike doing their taxes, and 31 percent of those respondents say the process is too complicated. Filing your taxes is expensive, in both time and money: ProPublica reported in 2019 that “Americans spend an estimated 1.7 billion hours and $31 billion doing their taxes each year.”

When you’re elbow-deep in documents and receipts, poring over tiny boxes filled with numbers and second-guessing whether you did, in fact, get married last year, you might ask yourself: does it really have to be this hard?

The answer is no. Many other countries, like Germany, Japan, New Zealand and the United Kingdom, have “exact-withholding” systems. For the most part, the government alerts taxpayers of their estimated income for the previous year and how much was withheld in taxes. Most taxpayers’ part in the process begins and ends with checking the government’s math and disputing any discrepancies.

You might ask: what’s stopping the United States from adopting this system? After all, the IRS already has the vast majority of taxpayers’ information on file. The agency’s duties could easily be expanded to simply sending most Americans a refund or a bill, depending on their income and taxes already paid.

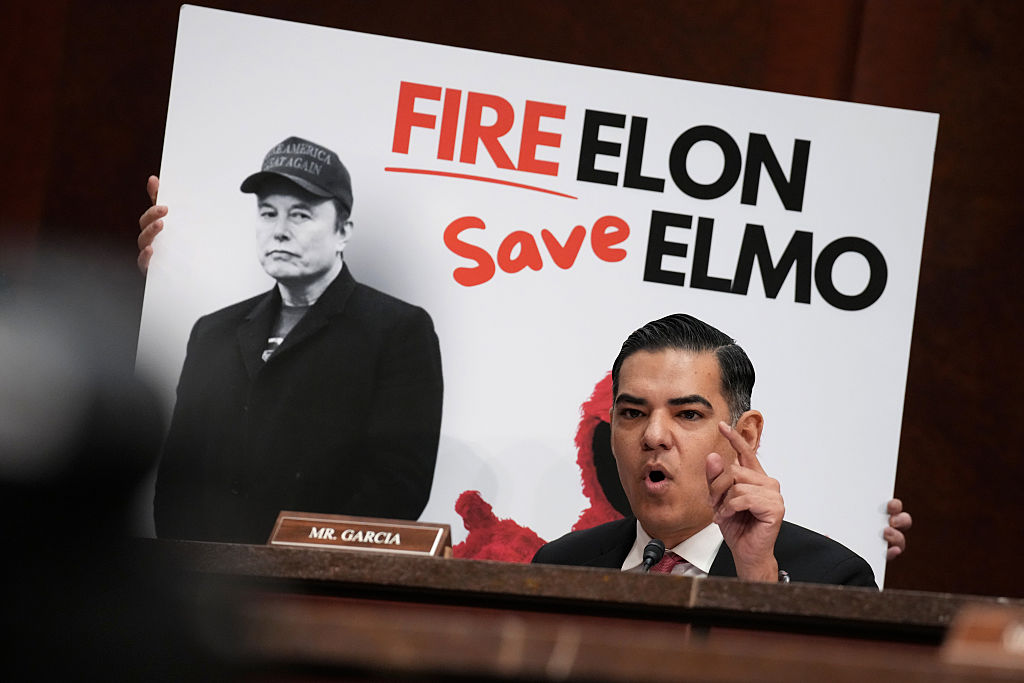

There’s a simple explanation: tax prep companies such as H&R Block and Intuit spend millions of dollars each year lobbying Congress to keep the current system in place. And they have good reason to do so: according to IBISWorld, tax prep services is an $11 billion industry in the US. No wonder both firms were able to afford lucrative $6.5 million ad slots during this weekend’s Super Bowl broadcast.

In 2002, the federal government entered into an an unholy arrangement and agreed not to provide Americans with a free tax preparation and filing service as long as private tax-prep companies provided a free option for those who qualified (about 60 percent of taxpayers). But ProPublica found in 2019 that Intuit was purposefully burying its free option and tricking customers into priced options during the process of filing. A year later, ProPublica reported that 14 million taxpayers who were eligible for free filing had ended up coughing up money to tax-prep services instead.

In 2020, H&R Block dispensed with the charade and left the “Free File” program altogether. TurboTax followed suit in 2021. It’s clear that the biggest tax-prep companies have never truly held up their side of the bargain when it comes to providing Americans with a free filing service.

A Nerdwallet survey found that 69 percent of taxpayers are fearful about some aspect of the filing process — making a mistake, paying too much or getting audited. Tax-prep companies profit off of this fear, assuring Americans that their trusted experts are reviewing your filings to make sure you don’t overpay or get slammed with penalties and interest — or worse — down the road.

The creation of a truly free, government-run program (or better yet, a switch to a return-free filing system, like the majority of other developed countries have) would unburden Americans of a needlessly stressful and complicated process — and free them from the tax-prep companies that are shaking them down every year.