As that peerless philosopher of the 20th century Marvin Gaye once pointed out, there are three things in life of which we can all be certain: taxes, death and trouble. Cockburn has long admired the late soul legend’s lyrics, but this week, that weary little aperçu has rung somewhat hollowly in his mind.

You will have no doubt read of the damning report published this week by ProPublica, investigating the murky relationship between the taxable assets and actual taxes paid by some of America’s billionaires. If so, you probably agree that it makes for thoroughly depressing reading. Not only do the investigative documents reveal the extent to which the aforementioned can quite legally minimize their exposure, but what really sticks in the Cockburn craw is how some of those named have publicly campaigned to be taxed harder themselves, while quietly arranging their affairs to ensure this doesn’t actually happen.

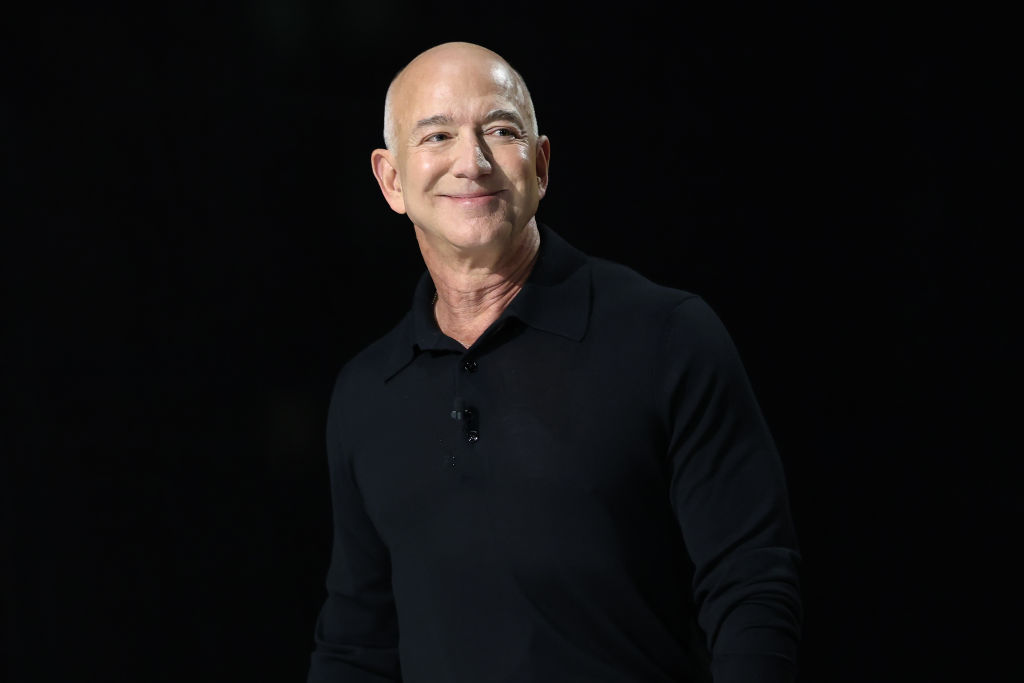

Among the individuals named in the report, are a roll call of familiar faces, around 25 in particular, including Mark Zuckerberg, Elon Musk, Mike Bloomberg and Jeff Bezos. Topping the least tax paid pops, however, is our old friend Warren Buffett, whose real income-tax rate has been calculated to be around 0.1 percent, a feat of fiscal callisthenics achieved by keeping his money in Berkshire Hathaway stock and avoiding paying dividends. ‘No one among the 25 wealthiest avoided as much tax as Buffett, the grandfatherly centibillionaire,’ ProPublica said.

This is almost as rich as Buffett himself. A decade ago, he made headlines when he published an op-ed in the New York Times, ‘Stop Coddling The Super-Rich’, in which he called for ultra-wealthy individuals to bear the highest tax burdens, thus relieving the pressure on the wider population. ‘My friends and I,’ he wrote, ‘have been coddled long enough by a billionaire-friendly Congress. It’s time for our government to get serious about shared sacrifice.’

Crocodile tears, says Cockburn. In ProPublica’s account, leaked IRS reports show that while Buffett’s wealth grew by $24.3 billion between 2014 and 2018, he only paid $23.7 million in taxes, after reporting taxable income of $125 million, all the while prattling virtuously about the need for his cohort of frantically rich billionaires to be taxed harder. Buffett himself has even had a tax protocol named after him, the so-called Buffett Rule, eagerly supported by Barack Obama in 2012, which proposed a higher minimum tax rate for the nation’s wealthiest citizens, ensuring our less well-off people pay less.

And it’s not only Buffett who’s been clever enough to have maneuvered himself out of the taxman’s sights. Mike Bloomberg, who, ProPublica revealed, paid zero income tax during one fiscal year recently, has reacted angrily to this week’s news and vowed to use ‘all legal means’ available to hunt down the source.

Interestingly, Cockburn seems to recall this same Bloomberg shouting noisily some years back about Donald Trump’s reticence in publicly declaring his taxes.

Another loud advocate of higher taxes for the rich, George Soros, the billionaire investor, is revealed to have not paid any federal income tax for three years in a row. And the internet’s favorite man, Elon Musk, responded to a journalist’s query about the claim that he had paid no personal tax in 2018, with a ‘?’

What gives? If Cockburn has to grimly fret and fuss annually over the misery of his tax returns, then surely so should those residing high on the upper slopes of our society’s money mountains? But of course, Cockburn and Buffett exist in two very remote financial universes. While Cockburn’s meager hard-earned cash is filleted by the IRS with predictably ruthlessness, Buffett, Bezos, Bloomberg and Musk and the 20 others named in the ProPublica report, can quite legally use the colossal resources at their fingertips — lobbyists, lawyers, bankers and corporations — to exploit the comforting legal loopholes that exist above the clouds, for those wealthy enough to pass through them.

Joe Biden has spoken in the past of his desire to see such loopholes closed up for good and instead boost taxes from investments and commerce to plug the colossal budget gaps that his trillion-dollar recovery plans will call for. Republicans, quite unsurprisingly, want no part of this. Those on the left of Biden’s party, such as the blessed Elizabeth Warren, are baying for blood, urging a wealth tax be introduced, pronto. However, before we can get into the bare-knuckle arena of who decides to tax who and how much, Cockburn understands the White House has condemned as illegal, ‘any unauthorized disclosure of confidential government information’ and the matter is now in the hands of the FBI and the IRS.

Will there be a moment, a shift in policy and an end to the billionaire gravy train? Cockburn will pass on whatever is heard coming through the grapevine, be assured.