The Labor Department reported this week that the December inflation rate hit 7 percent on an annualized basis, the highest since 1982. That was when the country was just beginning to recover from the inflation of the 1970s, the highest peacetime inflation in the nation’s history. The inflation rate for the last three months of 2021 was 9.1 percent.

The price of gasoline is up almost 50 percent over a year ago, used cars are up 37 percent and furniture is up 17 percent. Shortages cause by supply-chain disruptions are partly responsible for the upsurge (supermarket shelves have been notably empty in recent days). As grocery and food workers return to work after the latest surge of Covid, those prices should begin to drop.

But most of the inflation of the last year has been due to a marked increase in the money supply relative to the amount of goods and services available in the marketplace, thanks to vigorous pump-priming due to the pandemic.

Money is just a commodity, no different than petroleum or legal services. Thus it can rise and fall in price. What makes money unique among commodities is that it is the only commodity that is universally accepted in exchange for every other commodity. That’s why we have a special term for a fall in the price of money. We call it inflation.

The Nobel Prize-winning economist Milton Friedman wrote, “Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.”

Inflation is almost as old as money itself (coins date to about 650 BC). When Roman emperors began debasing their coinage, prices rose commensurately. The vast influx of gold and silver into Europe from the New World after the Spanish conquest caused about a 400 percent inflation over the course of the sixteenth century.

Financing wars by printing “fiat money” — money that is money only because the government says it is money — has been responsible for much of the history of inflation. The Continental Congress issued no less than $225 million in “continentals” between 1775 and 1779. Prices rose eightfold in those years. The phrase “not worth a continental” became a part of the American lexicon for a century.

In the Civil War, the federal government raised about 12 percent of its revenue needs with “greenbacks,” fiat money so-called because the reverse side was printed in green ink. Prices in the North rose about 75 percent as a result. The Confederacy had to meet about 50 percent of its revenue needs with fiat money. Prices rose 700 percent in just the first two years of the war and the Southern economy began to spin out of control, not the least of the reasons the South’s bid for independence failed.

In modern times, World War II caused considerable inflation, but most of it was suppressed until wage and price controls were lifted at the beginning of 1946. In the late 1960s, President Lyndon Johnson tried to pursue the Vietnam War while simultaneously extending the New Deal with programs such as Medicare, Medicaid and Head Start. The result was greatly increased government expenditures. Between 1965 and 1968, non-defense spending rose by a third, while defense spending rose 64 percent.

With most money by that time in bank balances, not coins and bills, the actual printing of money was no longer needed. Instead the Federal Reserve kept interest rates low by buying up federal bonds, printing the money in all but the actual printing. The effect was the same: inflation took off.

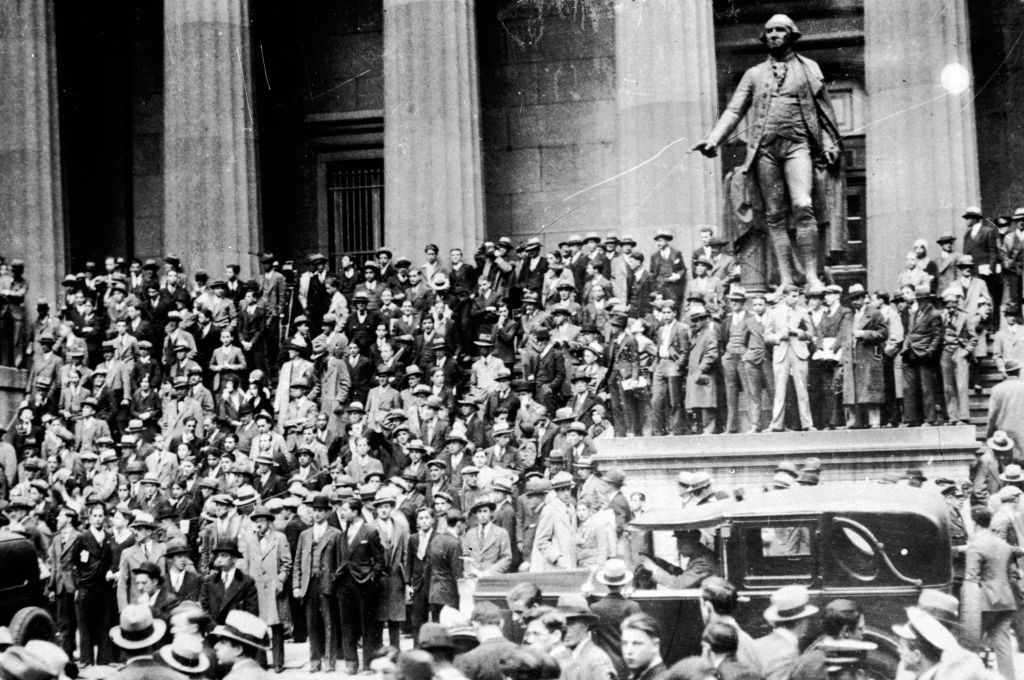

It reached 13.5 percent in 1980. Only when the new chairman of the Fed, Paul Volcker, induced a deep recession (unemployment reached 10.8 percent, the highest since the 1930s) did inflation subside. It then stayed low until the recent burst in the last year.

To meet the emergency of the pandemic and the economic shutdowns that resulted, the federal government has been creating money at an unprecedented rate, and prices began to rise. When people begin to expect inflation, it becomes a self-fulfilling prophecy. They start assuming inflation in the future and act accordingly, buying before prices can rise further and demanding wage increases.

Jerome Powell, the current chairman of the Federal Reserve, has promised to begin raising interest rates, even above what had been planned, if that is necessary to bring down inflationary expectations. But if the Build Back Better bill, which would add at least $5 trillion to the deficits over the next ten years, should pass (it seems unlikely at this point), the Fed would have to induce a considerable recession to end the current inflation.

That would be bad for the nation as a whole, but it would be a political disaster for the Democratic Party.