China is tacitly backing Putin’s aggression against Ukraine. The Biden administration should combat this by imposing economic costs on China through the corporate Environmental, Social and Governance disclosure requirements that are already in place.

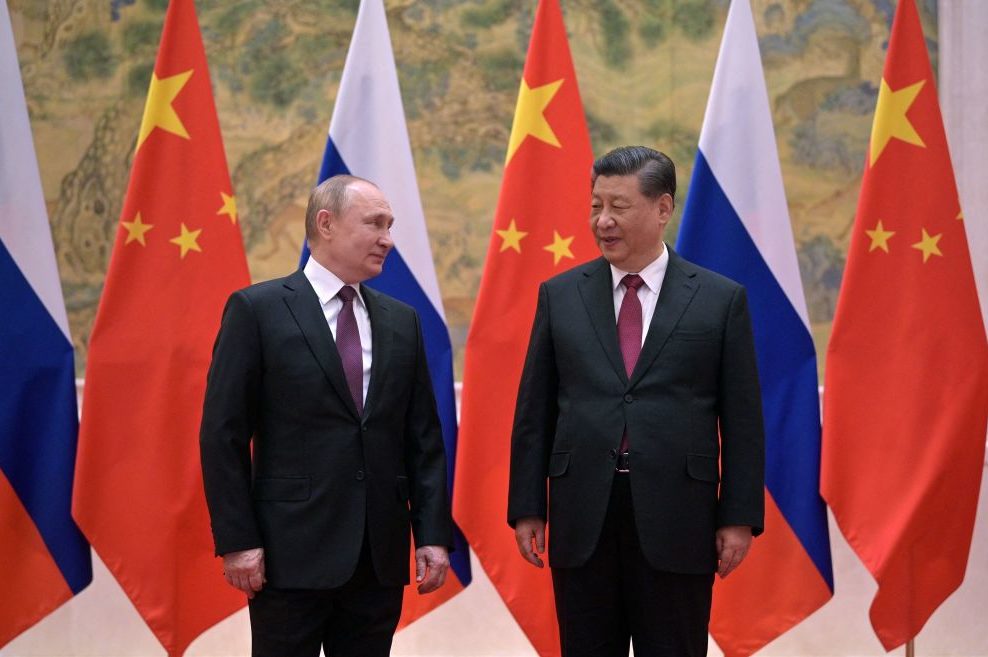

Xi Jinping and Vladimir Putin met in February at the Beijing Olympics, their thirty-eighth visit in the nine years since Xi took power. In a 5,000-word statement on February 4, Xi and Putin proclaimed their friendship with “no limits” and “no forbidden areas of cooperation.” Just weeks before the invasion, China signed agreements to buy from Russia energy and agricultural products worth over $200 billion.

Despite early reports that Xi was displeased with Putin’s decision to invade, China has since refused to condemn Russia at the UN and elsewhere — and has prohibited criticism of Russia in the Chinese media and on its heavily censored internet. This close partnership also had a military aspect: Russia felt comfortable enough to move two-thirds of the troops it normally kept on the Chinese border to the Ukrainian front.

China cannot be shamed into abandoning its support for Russia’s brutal aggression. We know this as the US and the Free World have publicly condemned the genocide in Xinjiang, but China has not relented.

Yet China is vulnerable to economic pressure. The Chinese people accept the dictatorship of the Communist Party in the expectation that their standard of living will continue to increase.

But China’s economic news has not been great recently. Its growth is pegged at just 5.5 percent this year, about half of what it has been since 1978. Even this may prove optimistic. The steady decrease in the working age population since 2011 is continuing, which will further dampen growth. Xi’s imposition of greater Chinese Communist Party control in the economy has increased uncertainty about many of China’s most dynamic companies. In the short term, rising coronavirus cases and the CCP’s “zero Covid” approach to lockdowns could further hinder the Chinese economy.

Financial news has not been great either. The Securities and Exchange Commissions has increased financial disclosure requirements for Chinese companies which will result in many delistings. The Nasdaq Golden Dragon China Index, which tracks American depository receipts of Chinese firms is now down about 75 percent from its peak in 2020.

China needs exports to fuel its economic growth. One third of its exports are to the US and the EU and it has stock listings worth trillions of dollars on the stock exchanges of the free world.

Because of this dependence on economic relations with the free world, China can be held to account using ESG standards.

It is generally accepted in the US and the West that companies must be mindful of environmental, social and governance criteria, especially regarding pollution, rule of law and financial audits.

About 80 percent of major global companies have ESG disclosures in their financial statements. In the European Union it is a legal requirement. In the US it is the result of regulation by the SEC, peer pressure and activism by large index funds. The premise of ESG disclosure is that companies that violate ESG rules are riskier and that investors must be informed of these risks.

Chinese firms are already major violators of ESG criteria, especially through pollution, infringements on workers’ rights and their complicity in acts of repression by government authorities.

The Biden administration’s SEC should ask Chinese companies to disclose their compliance with ESG criteria — and consider involvement with Russian companies as an ESG risk.

Part of this Russian risk is economic and financial. A growing list of Russian companies are affected directly or indirectly by sanctions imposed by the US and the rest of the world, and by international boycotts.

But there are also legal and reputational risks. Given the animosity towards Russia among western consumers, US investors may become less likely to do business with Chinese firms that maintain Russian ties.

Chinese companies that want to do business in the Free World, have their securities traded on its exchanges or obtain loans from its banks should disclose if they do business with Russian corporations. Informed by these disclosures, investors and consumers will know which firms to invest in and which to boycott.

Dan Negrea is a senior fellow at the Atlantic Council’s Scowcroft Center for Strategy and Security. Between 2018 and 2021, he served at the Department of State in the Secretary’s Policy Planning Office and as the special representative for commercial and business affairs.