Federal Reserve Chairman Jerome Powell looked calm when he testified before the Senate Banking Committee in February 2021. He’d just been asked by the folksy Louisiana senator John Kennedy whether he had concerns about the dollar supply being the highest it had been since 1946.

“Right now, I would say the growth of M2, which is quite substantial, doesn’t really have important implications for the economic outlook,” Powell stated. “M2 was removed some years ago from the standard list of leading indicators, and just that classic relationship between monetary aggregates and economic growth in the size of the economy, it just no longer holds. We’ve had big growth of monetary aggregates at various times without inflation, so something we have to unlearn, I guess.”

Powell had previously brushed aside other worries about inflation, saying he didn’t expect a situation where it “rises to troubling levels.” He vowed that there were tools in place to get a hold of inflation if it rose sharply.

Treasury secretary Janet Yellen also seemed untroubled by inflation in May 2021, telling the Atlantic that she believed an interest rate hike was possible to make sure that “our economy doesn’t overheat even though the additional spending is relatively small relative to the size of the economy.” Yellen later told the Wall Street Journal that she wasn’t advocating for an interest rate hike. “I don’t think there’s going to be an inflationary problem, but if there is the Fed can be counted on to address it.”

Economic analysts echoed Powell through the summer of 2021. Dylan Matthews argued at Vox last July that the federal government needed to get more involved in the economy, stating that it “should be intervening in specific areas to keep specific types of prices that are rising rapidly from further accelerating.”

Former labor secretary Robert Reich scoffed in the Guardian that income inequality, not inflation, was the issue most troubling America. “The wealthy spend only a small percentage of their income — not enough to keep the economy churning,” he wrote. Reich pushed the Biden administration to go further in its economic stimulus attempts. “Lower-income people, on the other hand, spend almost everything they have — which is becoming very little. Most workers aren’t earning nearly enough to buy what the economy is capable of producing.”

Come 2022 and their tune has completely changed. The Fed last month raised interest rates, with another hike expected this year amid three straight months of record Consumer Price Index jumps. On CNBC, Yellen warned, “We’re likely to see another year in which 12-month inflation numbers remain very uncomfortably high.” Reich sent a public memo to President Joe Biden about what he called out-of-control inflation, blaming it on corporations and the rich not wanting to pay a fair share. Matthews admitted he’d been wrong about inflation but said that a lot of people had been wrong about it. He hoped interest rates would slowly go up to avoid a recession.

That still raises the question: how was everyone so wrong?

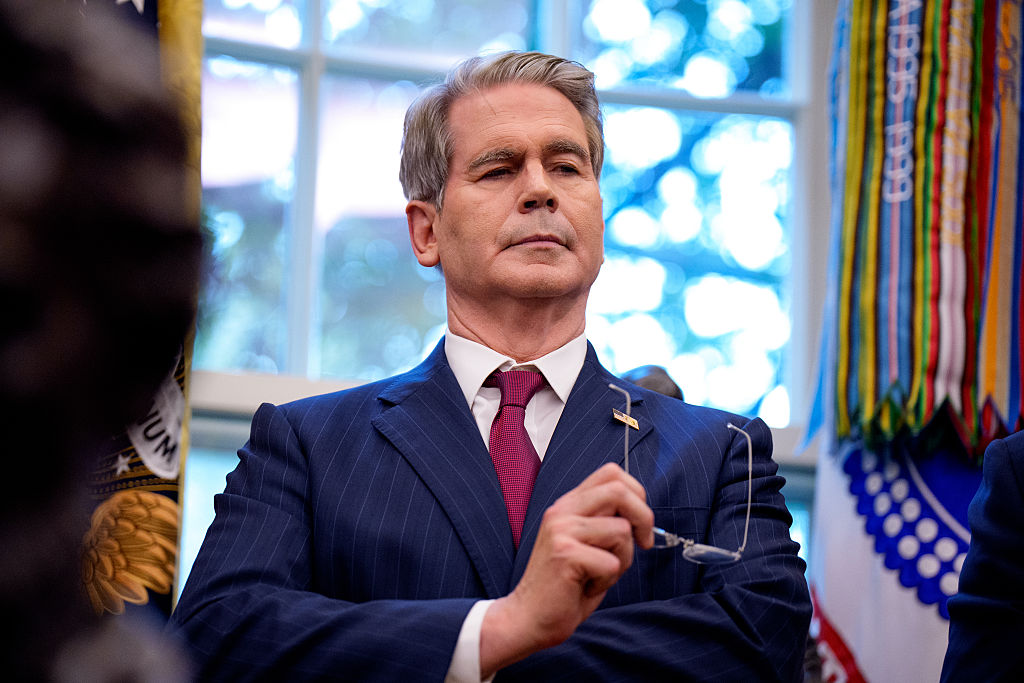

“Economists chose to ignore the likelihood of inflation as they tried to recover from the pandemic,” Dr. Thomas Hoenig, a distinguished senior fellow at the Mercatus Center and former president of the Federal Reserve Bank of Kansas City, told me over the phone. “In other words, the government was spending more money. They were putting more money in the hands of consumers to spend, and the economists were seeing that demand was increasing, and supplies were constrained. But they really chose to say, ‘We can take care of this later.’ And in doing that they ignored the potential for inflation to break out….”

Hoenig believes the government knew it was printing too much money, as evidenced by Powell’s February 2021 comments to the Senate, but chose not to acknowledge it until last month when inflation could no longer be ignored. Too much money and too few goods meant prices went up dramatically.

Why the government chose to ignore inflationary evidence depends on who you talk to among anti-inflation hawks. Steve H. Hanke, an economics professor at Johns Hopkins University and one of the world’s leading experts on inflation, told me that the White House and the Fed put out “disinformation” about inflation conditions in the US in the hope of getting “the Fed and the White House off the inflation hook.”

Hoenig agrees for the most part, saying that the government “should have known better” than to ignore their very large balance sheet and a market engorged on US dollars. He cited large increases in asset inflation over the last decade: “Everyone knows that they are responsible for this inflation now.”

Neither economist buys the White House’s line that Russia’s invasion of Ukraine was main reason for the inflation spike. “The Putin inflation fiction is just another White House excuse,” Hanke said in an email. “Indeed, it’s just another piece of disinformation to get the inflation monkey off the President’s back.”

“It is not an explanation for why we had inflation at almost 8 percent a month ago, before the invasion.” Hoenig told me. “And that was due to the spending that the Congress and the administration did and it’s a reflection of the monetary policy that the Central Bank of the United States did for a good fifteen months past the start of the recovery.”

Both Hanke and Hoenig want the Fed to carefully keep raising interest rates, which might mean a recession of some kind next year. Deutsche Bank and Bank of America are both predicting that the economy will slow. Hoenig wants the Fed to be consistent in bringing down inflation. He fears they’ll exacerbate the issue by reversing course and “in the long run make inflation worse than it is today.”

Only time will tell.