Not all inventions change the world. But some do — and they do it by greatly lowering the cost of a fundamental economic input. This inevitably causes an economic revolution that brings about a new political and social order by opening previously impossible economic opportunities, creating vast new wealth in the process.

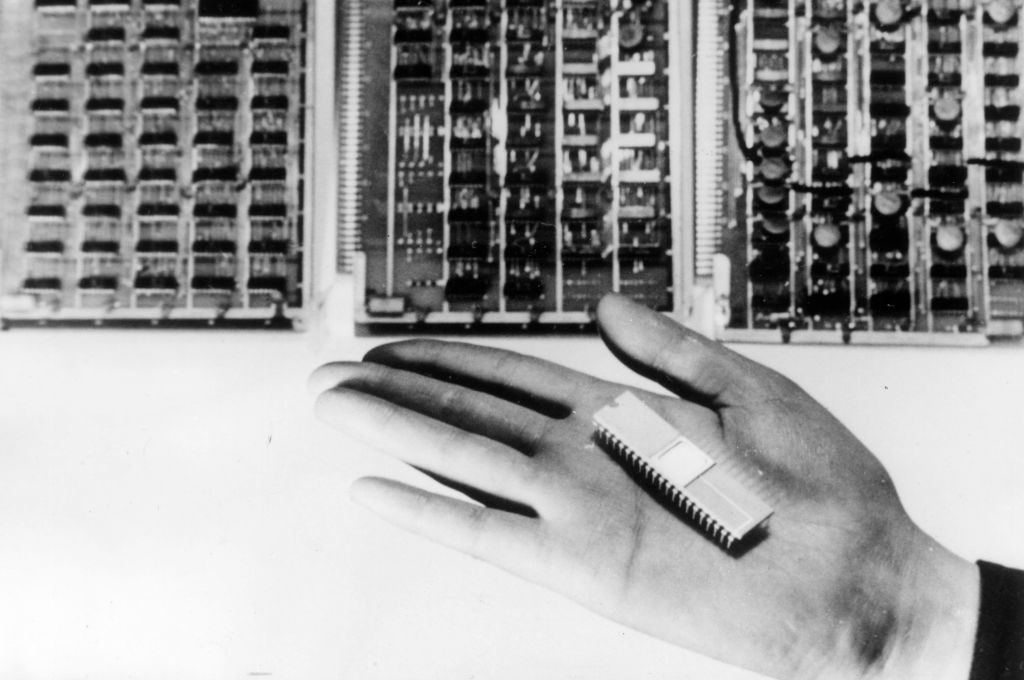

We are in the middle of such a revolution today, thanks to the microprocessor, which first came to market in 1972 and really took off with the introduction of the personal computer in the early 1980s.

The microprocessor, a dirt-cheap computer on a chip, hugely reduced the cost of storing, retrieving and manipulating information. Computing power that cost $1,000 in the 1950s today costs a fraction of a cent. That’s how every schoolboy can have computing power in his backpack that the Pentagon couldn’t have afforded fifty years ago.

One result of the microprocessor has been an explosion of wealth such as the world has never seen before. To make the Forbes 400 list in 1982 you needed about $250 million (in today’s dollars). There were only thirteen billionaires on that first list. To make the list today requires a net worth of no less than $2.9 billion. Indeed, there are more than 300 American billionaires not rich enough to make the Forbes 400.

And for every billionaire, there are thousands of centimillionaires and millions of mere multimillionaires. The Credit Suisse Global Wealth Report says that just last year the United States saw the creation of 1.73 million new millionaire households, bringing the total to an astounding 21.95 million.

Of the ten richest Americans on the 2021 list, none began life already rich and only Warren Buffett made his money the old-fashioned way, in his case through passive investment. The other nine fortunes are all the result of the microprocessor, either directly, through software, or indirectly by exploiting the new technology to deliver goods and services in new ways, such as Amazon, Google and Facebook.

This has happened often before in human history.

The full-rigged ship, developed in the middle of the fifteenth century, opened up the world’s oceans to European exploration and trade. So much gold and silver flowed into Europe from the New World during the sixteenth century that there was a 400 percent inflation, thanks to the greatly increased money supply outstripping the production of goods and services.

The spice trade with the Far East, for instance, was immensely profitable — assuming that the ship made it safely back to Europe, which a good many did not. When Sir Francis Drake returned to England after his three-year circumnavigation of the globe, loaded with spices, Queen Elizabeth I’s share of the profits exceeded all other crown revenues that year.

In 1769, James Watt introduced a new, much more fuel-efficient steam engine. Then in 1781 introduced a steam engine that could turn a shaft and thus power machinery. Before the Watt engine, the only sources of work-doing energy were human and animal muscle power, watermills and windmills. All had severe limitations and could be scaled up only to a very limited degree. But the steam engine could supply almost unlimited power. (The largest steam engine ever built powered the entire Philadelphia Centennial Exhibition, the first American world’s fair, in 1876.)

For the first time in human history, work-doing energy was cheap and the result was to put the Industrial Revolution, already beginning in the Midlands of England, into high gear. By the 1820s, unprecedented fortunes based on industry were being created. In 1827, Benjamin Disraeli coined the word millionaire (or, more accurately, borrowed it from French) to describe the new industrial barons.

The next year, the social critic John Sterling wrote, “Wealth! Wealth! Wealth! Praise to the God of the nineteenth century! The Golden idol! the mighty Mammon! such are the accents of the time, such the cry of the nation… There may be here and there an individual who does not spend his heart in laboring for riches but there is nothing approaching a class of persons actuated by any other desire.”

In 1829, the most significant subsidiary invention of the steam engine began with the opening of the Manchester and Liverpool railroad in England. A fundamental economic input, transportation costs, collapsed in price. Before the railroad, freight moved by water or it did not move at all. Every small town had its own shoemaker. Local blacksmiths made nails. But railroads made possible swift and cheap overland transportation. This not only reduced the cost of myriad goods, but allowed the development of national markets, with huge economies of scale. Once again enormous new fortunes — Vanderbilt, Harriman, Stanford, Morgan among them — were created.

Today, while the digital revolution has by no means run its course, there are already new technologies on the horizon that will remake the world economy once again and create new fortunes. Elon Musk is developing reusable rockets in his company SpaceX. That has already lowered the cost of putting cargo into space by a factor of ten. That will greatly increase the commercial possibilities of space-based technology.

In each of these technological revolutions, new laws were needed both to exploit the new possibilities and to make sure that the holders of the new fortunes didn’t evolve into a plutocracy.

With long distance trade very lucrative but also very risky, the limited liability corporation soon developed, to spread that risk. The rise of the middle class in Britain in the early nineteenth century, thanks to the steam engine, led to the great Reform Act of 1832 that empowered the middle class and curbed that of the old landed aristocracy that had run the country for centuries.

The rise of giant industrial corporations in the late nineteenth century led to antitrust laws to maintain competition, capitalism’s secret weapon.

Today, we are just beginning to figure out how to deal with the consequences of the digital revolution. Tech companies have become the modern agora, whether we like it or not. Can we allow immensely rich private individuals who like everyone else, have their own political interests, have sole control over it, and decide what can be said and not said in that agora? That would create a plutocracy that the Robber Barons of the turn of the twentieth century could have only dreamed of.

I have no doubt we will work out the necessary rules. And I have no doubt that, thanks to the great American philanthropic tradition, these vast new digital fortunes will be put to use in ways that benefit society as a whole.