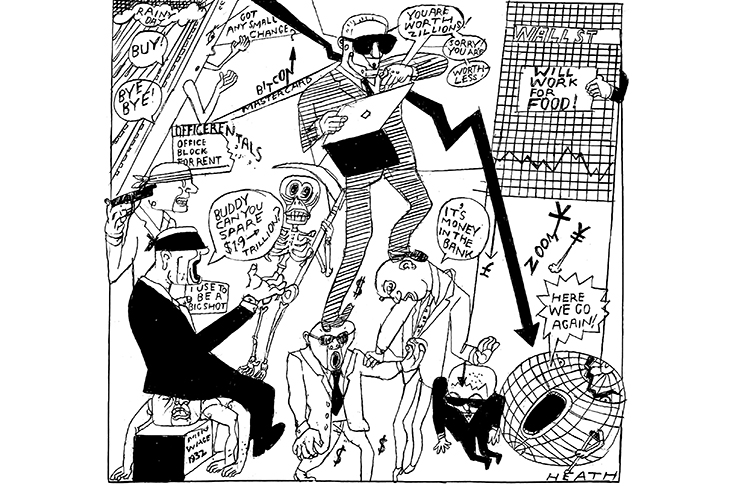

Shops are boarded up. More than four million Britons are on furlough with little idea of whether they will have jobs to go back to. Global trade has hit levels last seen a decade ago, and government deficits are soaring, while most developed economies have seen output shrink by 10 percent, a collapse not seen since the Great Depression of the 1930s. On just about every measure imaginable, the global economy has never been in worse shape, and we are all a lot poorer.

And yet here is a puzzle. Why can’t we see any evidence for that in the financial markets? Instead we are witnessing a series of extraordinary, epic bull markets. Crypto-currencies finally took a dive this week, but Bitcoin has quadrupled in value in recent months. Tesla is worth more than Toyota. Commodity prices are racing upwards, and small day traders are taking on the big Wall Street hedge funds, sending prices of obscure companies through the roof. The apocalypse has never been so profitable.

Welcome to the strange, looking-glass world of what is starting to be referred to as the Up Crash. Even as the world grapples with a pandemic, asset prices have been exploding and anyone riding those trends will be making a lot of money. Crazy? The markets behaving in ways that are even more unhinged than usual? Well, there may be an element of truth in that. And yet the Up Crash is also completely explicable, even if not entirely rational. Powerful trends are coming together. The global policy elite has formed a consensus on a version of free-spending Keynesianism that has not been seen since the 1960s. Technology has been accelerated by the pandemic, disrupting old industries, and creating new ways of working at lightning speed. And the markets have a whiff of insurrection about them as new players usurp the traditional bastions of financial power. The result? Prices are moving very, very fast.

A few examples illuminate how wild many different markets have become. Last week, Bitcoin was trading above $50,000 a unit, up from $5,000 (yes, that is the right number of zeroes) a year ago, and the currency is now collectively worth more than $1 trillion. Tesla is worth $670 billion, more than Toyota and Volkswagen, the world’s two largest auto manufacturers, combined. The obscure computer games retailer GameStop saw its shares soar from $20 to $330 as hordes of small traders talking to one another over the web piled into the stock, taking on the hedge funds that were selling it short, and beating them at their own game. New listings of companies are accelerating all the time, and attracting sky-high valuations; Bumble, the woman-focused dating app, saw its share soar 70 percent on the first day of trading, netting a $1.5 billion fortune for its founder.

There is a mania for what is known as Special Purpose Acquisition Companies, or SPACs for short, which list their shares with the sole purpose of buying other businesses, usually unknown. Almost purely hype (Augustus Melmotte’s South Central Pacific & Mexican Railway in Anthony Trollope’s classic satire of City speculation The Way We Live Now was a model of sober investment by comparison), 250 were launched last year, raising a combined $83 billion. Another $20 billion was raised in January alone. For what? No one really knows, but the money will have to be spent somewhere. Overall, the bull market that started after the March crash has been the fastest since the recovery of 1932: the S&P 500 is up 75 percent since its low point, just below the 78 percent rise in 1932, but more than any of the other 12 bull markets since then.

The total value of all the quoted equities in the world has hit $110 trillion, the highest on record, and equal to 126 per cent of global output (yup, you guessed right, that is an all-time record as well). The value of the global bond market this month hit $67 trillion, another record. Green energy is going crazy, with Invesco’s Solar ETF up 400 percent in the past year. PayPal, with a market value of $310 billion, is level with the mighty Mastercard after briefly overtaking it. The space exploration sector, perhaps the ultimate frontier market, is buzzing with activity, and who can blame anyone — this planet often seems past its sell-by date, so heck, why not try another one? Elon Musk’s SpaceX is now valued at $74 billion after its latest funding round, while shares in Richard Branson’s perennially optimistic Virgin Galactic have tripled in the past year.

The last crisis produced a bubble in the price of sports cars. Now it’s sports cards. One of Michael Jordan trying his hand as a baseball star sold for $712,000 this month, after trading at just $200,000 a few months earlier. There is even a trading platform where you can speculate on the value of cards. The list goes on. With economies in lockdown, and with GDP taking its worst hit since the 1930s, we are all a lot poorer than we were a year ago. So why the exuberance?

The most immediate cause is the fact we are experiencing a stimulus on an epic global scale. Central bankers, finance ministers, academics, think tanks and the International Monetary Fund and World Bank have formed an ultra-Keynesianism consensus. We have not been in this territory since the 1960s, with wild spending on moonshots, the Vietnam War and lavish social programs. President Joe Biden has promised a $1.9 trillion blast to lift the American economy out of recession and create a green revolution. His plan includes sending a $1,400 check to everyone earning less than $100,000 a year: in effect, free money. Canada, the most sober of nations, is racking up the biggest deficit in its history. On the other side of the Atlantic, the EU has started issuing debt for the first time, with its €750 billion coronavirus recovery fund. Germany, traditionally the most frugal of major economies, is debating easing the ‘debt brake’ which puts a constitutional limit on deficits. France is about to overtake Italy as the third most indebted nation in the world. In the UK, we may see the free-spending of the Johnson government as typical of the prime minister’s personal brand of flashy, big project boosterism. But in fact, as in so many other ways, he is a fairly conventional politician who is simply doing what everyone else is doing. Our spending is fairly modest by what are now global standards.

It’s not as if anyone was exactly being frugal before the pandemic. The Federal Reserve’s balance sheet — in layman’s terms, basically the amount of money it has printed — this month hit an all-time record of $7.5 trillion, or 35 percent of US GDP. Overall, the money supply in the US — M2 in the jargon of economists — has risen by 24 percent in the past year, the largest annual increase since 1943, when America was paying for the cost of fighting World War Two. The European Central Bank has gone much further, expanding its balance sheet to €7 trillion, which is 71 percent of the zone’s GDP (to round out the big four, the Bank of England is on a relatively modest 36 percent of GDP, while the Bank of Japan is ahead of everyone on 126 percent).

We are surfing a tidal wave of easy money. Total global debt, according to the Bank for International Settlements, rose by $24 trillion last year to an all-time high of $281 trillion. Between them, governments, companies and householders owe 360 percent of GDP now, compared with less than 200 percent a decade ago.

Is anyone worried about that? Not really. A few economists have rung alarm bells: Larry Summers, Bill Clinton’s Treasury secretary and a former president of Harvard, has fretted publicly that Biden’s plan is too big, but such concerns are quickly drowned out. In the wake of the crash in 2008, governments bailed out the banks and ran up big deficits, but they also embarked on austerity programs to clear up the mess. This time around? The consensus is to spend, spend, then spend some more.

Moreover, the pandemic has telescoped a decade of technological change into a single year. In January, the Office for National Statistics reported that 36 percent of UK retail sales were online. A year ago, it was less than 20 percent, almost doubling in a year. Netflix has been adding 16 million subscribers per quarter. Zoom’s peak meeting numbers hit 300 million last year — which is a heck of a lot of sales presentations and employee reviews — compared with fewer than 10 million in 2019. The market for streaming concerts is now worth $600 million, and growing fast. Office rents are collapsing as companies decide they don’t need all that expensive space anymore. Department stores are being converted to apartments. Locked up for a year, we have converted to working, shopping and socializing online and it doesn’t look like we will ever go back. The result? Whole industries are being turned upside down in the blink of an eye, and that creates vast gains for the entrepreneurs who are in the right place.

The GameStop saga transfixed traders because they could see power shifting from the big investment banks, and the asset managers and hedge funds in their orbit, to a new breed of app-empowered small traders. Individual investors were a forgotten force for a century. No one cared what they thought. During the past year, they have come storming back, moving share prices, and determining the direction of markets. RobinHood, the tellingly named app favored by millennial traders, added three million traders in the past year alone, and its rivals have seen similar growth. Angry, chippy and vengeful, the online traders are more like a furious mob than mainstream investors. At the same time, financial power is shifting from Wall Street to Shanghai as China’s rapidly recovering economy eclipses the US.

Who is in charge, and who does the Fed chairman or the governor of the Bank of England call for a quiet word? No one knows any more. The result? The voices of calm have been silenced.

Where will it all end? We have seen Up Crashes before. An epic bull market started in 1932 even as the Great Depression ground on and the world headed unstoppably towards a global war. The Long Depression, the slump that lasted for the last three decades of the 19th century, also witnessed railway and emerging markets booms. Easy money, technological change and rapid shifts in economic power between continents are a potent, combustible mixture. And yet the Up Crash of the 1930s ended in war, and the consensual ultra-Keynesianism of the 1960s ended in the stagflation and chaos of the 1970s. Once the pandemic is over, we are meant to be heading for a new ‘Roaring Twenties’ as economies flare back to life: a re-run of The Great Gatsby era, but with less jazz and more Teslas. It is not impossible. But history suggests that a chaotic or catastrophic ending to the boom is more likely.

This article was originally published in The Spectator’s UK magazine. Subscribe to the US edition here.