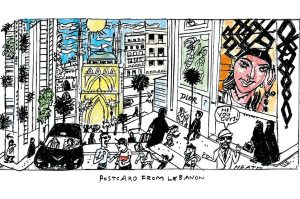

Lebanon will be 100 years old on September 1. But the joke circulating in Beirut is that the country may not be around for the party. Eye-watering hyper-inflation, not helped by the COVID pandemic, has brought the country to its knees, just as famine and extreme poverty sparked its creation after the end of the Great War.

Lebanon eventually won full independence from the French in 1943, and became an impossibly glamorous, multilingual entrepôt with a rare facility for doing business. According to Major General Sir Edward Spears, the British minister to Syria and Lebanon, the country ‘sprang from a far older and higher’ civilization than the French. Even so, it has always had a tendency towards self-destruction.

Lebanon’s obituary has been written before, notably during the 1975-90 civil war when the country went, practically overnight, from jet-set playground with a currency to rival the Swiss franc to a byword for death and destruction. But even then, during the darkest days of the Israeli invasion and the siege of Beirut, even after three decades of Syrian occupation, the emergence of Hezbollah and fallout of the Syrian civil war, the country’s foundations remained more or less solid.

We Lebanese are not by nature fighters. Despite our reputation for dispensing mayhem, money is our drug of choice and we prefer the balance sheet to the bomb. According to Yousef Beidas, who headed the Lebanese Intra Bank, once the Middle East’s biggest financial institution: ‘Lebanon is to money what the Suez Canal is to shipping.’

The trouble is we were getting high on our own supply. In recent years Lebanese banks became lazy, making money by lending to the state and by offering unfeasibly high interest rates — up to 14 percent — to dollar depositors. But in a country with a paper-thin economy, one that never actually produced anything other than weapons-grade cannabis and world-class wine, the central bank found it could neither pay back the annual interest it owed to the local banks, nor service the $86 billion public debt, the third worst debt-to-GDP ratio in the world.

It all unravelled spectacularly after a spontaneous popular revolution last autumn, which was ignited after a proposal to tax WhatsApp calls. The Lebanese, who love talking on the phone as much as they love doing deals, took to the streets demanding an end to the political class that had plundered the country for 30 years. The banks panicked and imposed crude, not to mention illegal, financial controls to stop capital flight. Currency meltdown ensued and the Lebanese lira, which had been artificially pegged to the US dollar for 23 years, nosedived, losing up to 70 per cent of its value against the greenback.

Nine months on, loan sharking is rife, savings and pensions have been wiped out, and salaries are a fraction of their previous value. Businesses, schools and seats of higher learning, including the distinguished American University of Beirut, are going — or are in danger of going — bust. Hospitals are running out of drugs. There is an estimated $8 billion under mattresses across the country. The banks are in intensive care and so, by extension, is Lebanon.

The IMF immediately offered to step in with a bailout plan loaded with necessary reforms that ultimately proved too painful for Lebanon’s mobsters. They were reluctant to give up the lucrative revenue streams — government contracts, control of key infrastructure, customs, ministries, local slush funds and so on — that fund their patronage. Earlier this month an exasperated team of IMF negotiators all but gave up. ‘We have been begging them to behave like a normal state,’ said one senior official, ‘and they are acting like they are selling us a carpet.’

And so the politicians, and the bankers with whom they are in cahoots, live in denial, hoping that salvation will come from somewhere less painful. Enter Hassan Nasrallah, the enigmatic leader of Hezbollah, the Iranian-backed militant Shia party, which controls many, if not most, of the levers of power. Nasrallah is rarely seen in public. A couple of weeks ago, in a televised address, he resorted to the well-thumbed Arab playbook and declared that Lebanon’s financial woes were down to an American plot, and that the country’s economic future lay with Russia and China. It is true that Hezbollah’s main sponsors in Tehran have moved closer to Beijing in recent years. But in reality Nasrallah’s words were nothing but speculative chaff, verbal Valium to sedate supporters who still believe his party to be a morally pure buffer against the twin evils of America and Israel.

[special_offer]

Hezbollah, with its impressive militia and much-vaunted arsenal of ballistic missiles, is arguably the biggest of many obstacles to Lebanon’s salvation. The party made its name resisting Israeli occupation in south Lebanon in the 1980s and 1990s. But after Israel withdrew in 2000, Hezbollah conned the Lebanese into thinking it was the only thing standing between them and future Zionist expansion. And like a cancer, it grew, using its alliance with the Christian Free Patriotic Movement as cover for an expansion policy that saw it buy land and properties. It inserted constituents in previously non-Shia areas, and created a system of patronage by milking state utilities and controlling the port of Beirut. As long as its supporters are happy, it doesn’t particularly care about the wider economy or anxious depositors. Iran, meanwhile, would love a franchise on the Mediterranean; one with a well-armed private army on Europe’s, and Israel’s, doorstep.

Ironically, the solution, if indeed there is one, is not to take on Hezbollah. Any war, presumably involving Israel, would only lead to armageddon. The priority must be a resumption of the popular pressure, similar to the street protests in October and November, to bring the IMF back to the table. The channels of corruption must be cleansed, infrastructure improved and the banking sector reformed. Part of any reform package must also include the creation and international management of a sovereign wealth fund for the revenues from the estimated 1.7 billion barrels of oil and 122 trillion cubic feet of natural gas which Lebanon might own (and which, incidentally, the political class had already started divvying up before anything had been pumped to the surface). With this, Lebanon could — and it’s a big could — become a second Norway. At the same time, the UK and the US must not abandon their support for the small but internationally respected Lebanese Armed Forces. The LAF is the last line of state security. If soldiers’ salaries are worthless, the fear is they will melt away into their communities and the country will descend into sectarian conflict as it did in 1975.

And let’s not forget that for such a spectacularly dysfunctional country, Lebanon is founded on the bedrock of consensus — there are 18 officially recognized faiths including Judaism — and any attempts in its short history by one sect or party to dominate the rest have failed. So, Hezbollah’s vaulting ambition aside, the challenge is to finally cut out the cancer of corruption and for Lebanon to once again flourish in its own charming, albeit unconventional way. It is a vibrant, pluralistic and necessary nation. It should not be allowed to die.