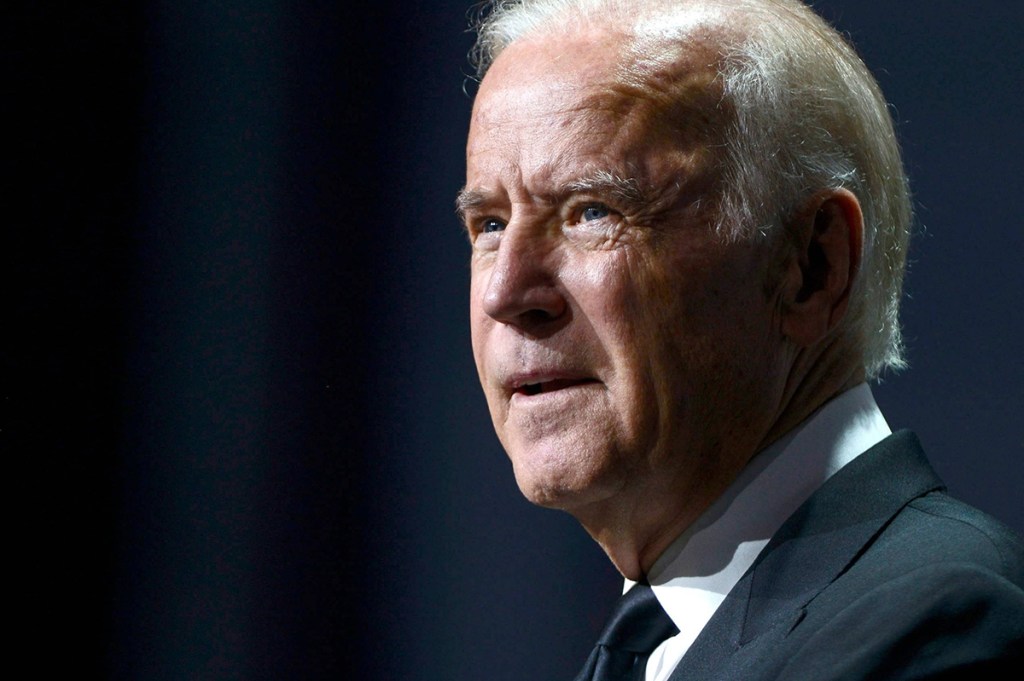

I have a horrible feeling that the Biden presidency may come to be defined by a single quote which will echo down the ages, featuring not just in economics textbooks but becoming a byword for hubris of all kinds. Speaking of his $1.75 trillion “Build Back Better” plan, the president declared last week: “Seventeen Nobel prizewinners in economics have said that my plan will ease inflationary pressures.”

Not so fast, Mr. Biden. On Wednesday, the Bureau of Labor Statistics announced that the Consumer Prices Index for October rose to 6.2 percent, higher than expected and the highest rate since 1990, the very beginning of the low inflationary era.

For all the extra billions promised in tax credits, and the “helicopter money” which Biden has already showered upon the US population, Americans are facing a real-terms fall in their pay packets. The rate of real earnings growth in October stood at minus 1.2 percent.

What Biden is handing out with one hand, inflation is eagerly gobbling up with the other. Worse, inflation is being witnessed across all sectors of the economy, not just in hospitality – still waking up after 18 months in hibernation — nor in energy prices, which are up 30 percent over the year, but in food, housing costs, cars too.

The most shocking about the month’s inflation figure is that anyone should be surprised. Until fairly recently it was widely accepted that borrowing and spending vast amounts of money, still more printing it, would end up generating inflation. Then came the experiments with quantitative-easing after the 2008-09 crash — an emergency reaction to an unprecedented crisis, we were told, which somehow became permanent — and complacency began to set in.

Because we had a decade of loose money accompanied by low consumer prices inflation, the old rules were torn up. People began to dare to believe that we could have high spending, high borrowing, quantitative easing and still have low consumer prices inflation.

Yet inflation was there all along; it is just that it was largely limited to asset prices. Just look at the bizarre reaction of stock markets and property markets to the deepest recession of modern times — i.e. boom — and you realize the problem.

Consumer prices stayed low because — up until Trump’s trade war with China and the choking of global trade which came with the pandemic — the West continued to benefit from the deflationary effects of the transfer of productions to a rapidly expanding South East Asia.

But Biden, even more so that his predecessor, seems determined to end that deflationary influence. His Build Back Better plan is full of promises to repatriate production to the US — with huge sweeteners, for example, to motorists who buy electric cars made in America.

No, the pandemic hasn’t made us all richer, even if our houses and share portfolios are worth more. Governments and central banks can print money, but they can’t print wealth — and inflation is the great correctional device which prevents us getting something for nothing.

The president’s quote is a prime example of how governments have come to over-rely on advice from credentialed academics rather than use their own reasoning ability. Whatever these 17 Nobel prize-winners really told Biden about Build Back Better, there are no Nobel prizes on offer for making the point that just because inflation has generally been low across the globe for the past three decades it doesn’t mean that that benign situation will necessarily last.

This article was originally published on The Spectator’s UK website.