America’s economy has officially recovered to its pre-pandemic levels, as Q2 GDP figures saw an annualized increase of 6.5 percent. This is a positive update, on the face of it, but that’s more or less where the good news stops. The country’s GDP figures have come in notably below the consensus of what was expected, which was something closer to 8.5 percent.

The news comes just a day after the International Monetary Fund forecast the United States and the UK would lead advanced countries with their rate of economic recovery, revising its estimates for the States upwards to 7 percent this year and 4.9 percent next year.

Some forecasters remain optimistic, with the CEBR describing the news as evidence of ‘a successful second quarter for the US economy’ and still predicting ‘US GDP growth of 7 percent in 2021’ — similar to the IMF. But others are not as bullish. Capital Economics (CE) reckons there could be a slowing down of America’s GDP growth to ‘3.5 percent annualized in the second half of this year’. Other forecasters may follow suit, as the country’s many challenges grow more evident. CE’s chief US economist Paul Ashworth attributes the disappointing figures to a myriad of factors, including the ‘impact from the fiscal stimulus waning, surging prices weakening purchasing power, the Delta variant running amok in the south and the saving rate’ coming in lower than estimated.

Unemployment also remains a problem, as the lack of a US furlough scheme saw a far greater spike in those out of work, especially at the start of the pandemic. Monthly unemployment claims are still coming in higher than expected: 400,000, compared to 380,000 estimated by the Dow Jones.

While the UK and US have had similar (world-leading) rates of vaccination throughout the winter and spring, the US has now fallen out of the top 10 most vaccinated countries.

Though it is still doing well compared to much of the world, America is struggling with its vaccination numbers now as it focuses on trying to convince those more skeptical or apathetic about the COVID vaccines to take up their shot. The Delta variant is spreading across the US, and states like Florida and Texas (which were managing a balance between limited restrictions and manageable cases) are now seeing a surge in infections. Having experienced its own surge in cases from the Delta variant this spring and early summer, the UK is now experiencing a downturn in daily case numbers, and remains in the top five countries for rate of vaccination.

But Ashworth’s warning about fiscal stimuli is perhaps a bigger cause for concern. It’s bad news indeed for President Biden that the results of his $2 trillion spending (with plans to spend $4 trillion more) are already thought by forecasters to be waning. Revving up the economy was supposed to be the upside of funneling trillions into the economy; the downsides look like they’ll be lingering around for far longer. With inflation now at 5 percent year over year, and with more borrowing set to continue, there’s far more threatening the US economic recovery than the mechanisms used for curbing the virus. It’s what former chief economist at the Bank of England Andy Haldane described as carrying on ‘pouring the punch’ at a party that’s growing increasingly out of control. This is something concerning the Bank of England now, as in the UK inflation data seems to be outpacing consensus, while recent growth figures seem to be falling behind expectations.

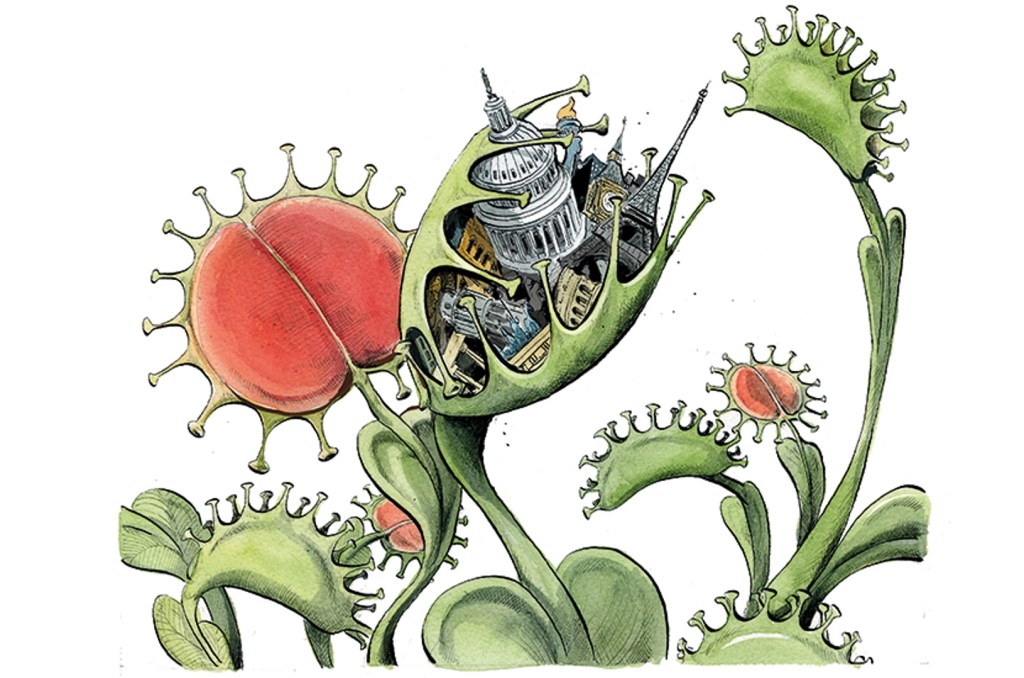

America’s GDP update adds to the theme of the week: what could derail economies that seem set for strong economic bounce-back? Lots of good news at the surface, but a far more precarious set of circumstances underneath.

This article was originally published on The Spectator’s UK website.