Donald Trump wasn’t a man for international agreements. Just imagine for a moment, though, that it was him rather than Joe Biden who had just persuaded the G7 to back a minimum global corporation tax rate. Would it be hailed as a great breakthrough for fairness, a sideswipe against amoral global corporations? Like hell it would.

On the contrary, the same deal pulled off by Trump would have been attacked as a charter for the big tax avoiders to carry on as they are — as well as a bullying attempt by the US to divert more tax revenues to its own shores at the expense of smaller countries with competitive tax rates.

There are two elements to the agreement reached over the weekend. The first is the proposed minimum tax rate of 15 percent. The second is an arrangement whereby multinational corporations would have to pay more of their tax revenues in the countries where they make their sales, rather than just where they are headquartered.

It is not hard to see how the US tax authorities will benefit. Take the case of a US company which has its main HQ in the US but which currently conducts its European operations through a regional HQ in Ireland, where the corporation tax rate is 12.5 percent. Under the agreed system, the US government will be able to help itself to an extra 2.5 percent, to make up the 15 percent minimum. Either that, or Ireland ups its corporation tax rate so that the company has less incentive to conduct business through subsidiaries in other countries. Either way, it is the US which benefits — or rather the US government.

But what about the second part of the proposal? Under the plans agreed at the weekend, any multinational would be liable to be taxed on 20 percent of its profits in the countries where it does business. But that 20 percent slice would only apply to profits above a 10 percent profit margin. Take, for example, a company with an HQ in the US and which sells goods or services to Belgium. The company has a global turnover of $10 billion and global profits of $2 billion. It sells $10 million of stuff in Belgium, on which it made profits of $2 million. In future, it would be liable to pay to the Belgian government corporate tax on half of 20 percent of the $2 million — i.e. it would pay Belgian corporation tax on $200,000.

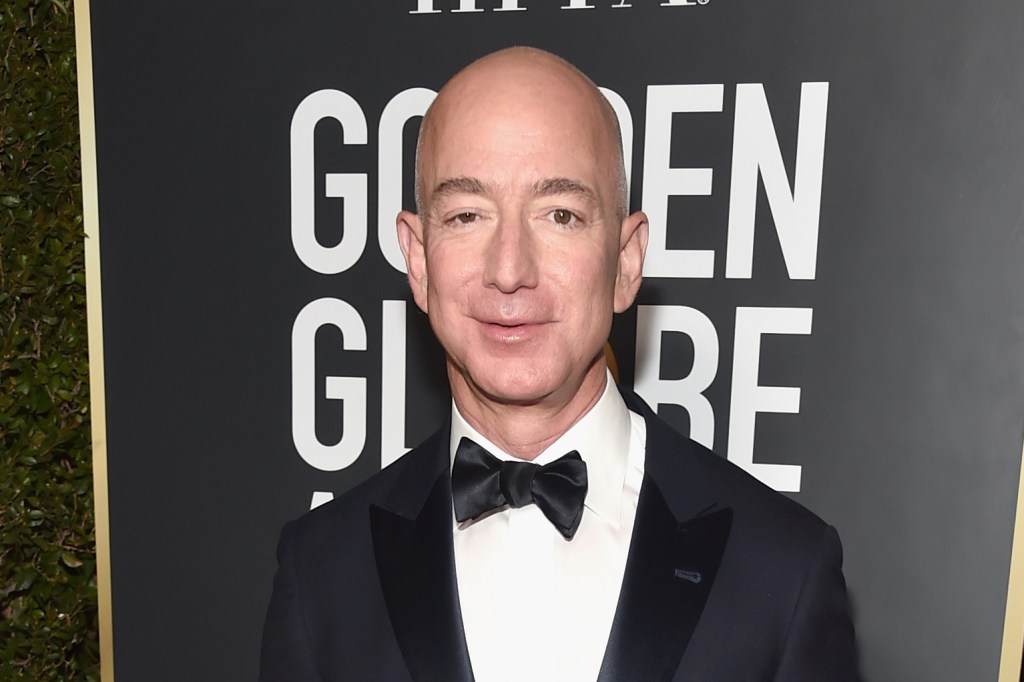

But here’s the rub. Not all multinational corporations have a profit margin of over 10 percent. Amazon, for example, had a profit margin of 6.3 percent of its $386 billion global profits in 2020. In other words, it is not going to be caught by this tax at all. Many other companies who do currently have profit margins above 10 percent will presumably already be thinking up ways of engineering margins below this threshold.

It is astonishing that the world, or part of the world at any rate, can sit down to work out a tax reform designed to trap what many consider to be industrial scale tax-avoidance by tech giants — and end up exempting at least one of those tech giants. It is hard not to imagine that more would not have been made of this absurdity had the agreement been the work of the Trump administration. Yet under Joe Biden and Janet Yellen it has been hailed as a breakthrough in international cooperation. We will see in due course what the G20 nations think of it, given that some of them risk seeing tax revenues drain away.